The solution that gets rid of expense reports

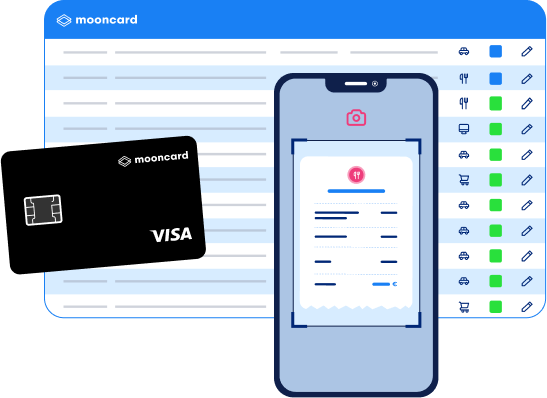

Free yourself from the admin and stress of expense reports. With Mooncard, all you have to do is pay and take a photo of your receipt. The information and approvals are managed automatically so there’s no need to do a report.

How does it work?

Pay, take a photo of the receipt, and your expenses are sent to the accounts.

-

Pay with your Mooncard

Anywhere in the world with the Visa network at merchants authorised by your company's travel and expense policy.You no longer pay out-of-pocket for the company.

-

Take a photo of your receipt

You will receive an SMS reminding you to take a photo of your receipt. You can then throw it away because it is digitally archived.

-

The expense report is automatically generated

The expense report is pre-filled thanks to our algorithms capable of identifying the nature, the amount, the VAT, etc. from the bank transaction.

-

The expense report is submitted for approval

Depending on the approval process defined by the company, the expense is then checked and validated by your manager or accountant.

.png)

Everything About Expense Reports

Definition, VAT, Reimbursement, Formats

Every company is likely to experience problems with expense reports once its employees incur expenses on behalf of their employer. It's a tricky issue that management must address. The management and reimbursement of professional expenses is complex, as several reimbursement processes exist (actual expenses, flat rate allowance, problems with supporting documents, etc.). Reimbursement terms are also important; there needs to be a tried and tested system in place and clear reimbursement terms to avoid delays or errors. Find out everything you need to know about expense reports now!

Mission Expenses Included in Expense Reports

When employees travel for work, they will probably incur expenses for meals eaten while away from home. Rather than reimbursing each meal separately, some companies choose to give their employees a meal allowance. It gives them the freedom to spend their budget how they want.

The meal allowance covers the employee’s meals when traveling. There may be times when the employee needs to charge the company for meals eaten with customers and prospects. Business meals shared with guests should not be authorised under the daily meal allowance. Instead, the employee should submit them under a different category, such as Entertainment Expenses, and not an everyday meal expense.

Read more

How to Create an Expense Report

Every business answers the question, “How to create an expense report?” in its own way. An expense report may be in an online template or a spreadsheet. Each company has its own policies about what the expense report should look like. All expense reports include the same basic information required for processing by the company accounting department:

- Employee name and address

- Employee Number, if applicable

- Employee telephone number

- Date expense was incurred

- Type of expense being claimed

- Amount being claimed (before and after VAT - Value Added Tax)

- Description of the expense

Reimbursement of Expense Reports

Expense reports are reimbursed once they have been received and approved by the company. Typically, the employee has paid the cost of the employment-related expense up front. They may have to wait to receive payment from the company. Depending on the company’s policy, it may take some time to receive the reimbursement.

If the employee’s manager or the accounting department has a question about a receipt, the expense reimbursement process takes longer than usual. The employee may need to answer some questions about the expense before it can be approved.

Management of Expense Reports

Management of expense reports has traditionally been a time-consuming process for all types of businesses. Each employee submits their expenses and receipts for approval and waits for the expenses to be processed. Once this process is completed, the employee receives payment for their business expenses.

It’s common for a business to have a specific template available for this purpose; asking each employee to use it when submitting their travel and other expenses makes them easier for the accounting department to track. The employee can also use software for submitting expenses. The accounting department will find it a lot easier to review them in this way, as opposed to having to enter them line by line into a database.

Mooncard allows your accounting department or your company accountant to receive employee expense reports digitally, in line with your business expense report policy. There is no reason for employees to submit paper expense reports that must be input manually again. Our unique accounting software integrates seamlessly with your existing software to make expense reimbursement an easy and convenient process.

Mooncard’s Excel report templates present your employee expenses in a clear, easy-to-read manner.

Read more

Expense report template

It can be very time-consuming for employees to fill in the expense report. There is no official model for expense claims. For this reason, it may be advisable to set up a single expense report template within the company. This table should be adapted to the company's different types of expenses, including mileage allowances.However, the real simplification is to be found in innovative solutions resulting from digitalization! Why not opt for Mooncard, the complete payment solution for companies? Read more

FAQ

When is the best time to submit an expense report?

Employees should follow the company’s guidance about how often to submit their expense reports. Some businesses like to review expense reports biweekly and others review monthly.

With Mooncard, there is no need to wait until a set date to submit expense reports and receipts to the company. The expense and the receipt are submitted to the company on the employee’s behalf immediately. This system means that employees don’t have to keep paper receipts in their wallet or a drawer and wait until a later date to submit them. All employee

Who manages expense reports?

Employee expense reports are processed by the company’s accounting department or its chartered accountant. Before they can be processed, the expenses must be approved by the employee’s immediate supervisor or department manager.

If there are any errors or omissions in the expense reports, they are returned to the employee for revision. The manager or department manager must then approve the revised version before the expense report can be processed.

What is an expense report receipt?

Employees who incur employment-related expenses must also submit receipts for the money they paid out of pocket. These receipts must be submitted along with the claim in order for the employee to be reimbursed by the employer, unless the employer and the employee have agreed to a different arrangement (such as a monthly allowance for car/mileage expenses).

Why should you digitise your expense reports?

Digitising expense reports is a sensible choice for modern businesses. If the process is digital, data entry is not necessary. The data goes directly into the company computer system, where it can be viewed and approved by a manager or returned to the employee for revision. If the expense report is approved, it can be forwarded directly to the accounting department for processing without any further delay.

Why adopt a business expense policy?

If a company doesn’t have a business expense policy, there is nothing to guide employees in how, when, and what business expenses are allowable. It is unclear which business expenses are allowable and which ones the company will not be covering for its employees when traveling. The business runs the risk of some employees having their expenses reimbursed while other employees do not.

This situation could lead to HR issues, such as the company struggling to find employees, and legal ones if the employees decided to seek legal counsel about unpaid expenses.

What are the types of compensation in an expense report?

An expense report may include cost-based or actual expenses and flat rate allowances for employees. Actual expenses are the specific amounts employees paid out of pocket for expenses for travel while on company business. These may include the cost of plane or rail tickets, meals, car rentals, etc. Entertaining clients or prospects by buying them meals would also fall under the category of actual expenses.

A flat rate allowance is paid out at regular intervals and doesn’t require receipts from employees. For example, an employee may receive a certain sum each month for a car allowance from their employer.

What are the legal obligations related to expense reports?

The legal obligations related to expense reports would be covered under basic contract law. The terms may be included in the employee’s written employment contract; that is to say, that the employer will be responsible for reimbursing the employee for reasonable expenses incurred during the course of their employment. If the employee submits an expense with a receipt proving they paid for an employment-related expense that the employee can show was reasonable, the employer has an obligation to reimburse the employee.

If the employee and the employer have a verbal understanding that the employer will reimburse the employee for reasonable employment expenses when accompanied by a receipt, then the employer is likely still bound to pay the expenses.

How to start digitalising expense reports?

If your goal is to start digitalising expense reports, start by looking at the way you currently process them. Are there any places where you can see that digitalisation can benefit your business? Digitalisation is simply allowing technology (software) to do a function that was formerly done by a human. When technology can do a process faster and more accurately, it makes sense to leverage it.

For example, digitalisation means that data entry is no longer part of your expense report approval process. The expense reports can be approved more quickly and your team members can focus on other, more interesting types of tasks.

Mooncard makes digitalising expense reports easy and convenient for you and your team. It doesn’t matter what size business you have, you can use Mooncard to help your employee expense report process run more smoothly and accurately. Your business will save time and money by digitalising this everyday process.

Need more information?

Our team is available Monday to Friday from 9 a.m. to 7 p.m. to present the Mooncard solution to you and work with you to design a tailor-made quote corresponding to your business needs.